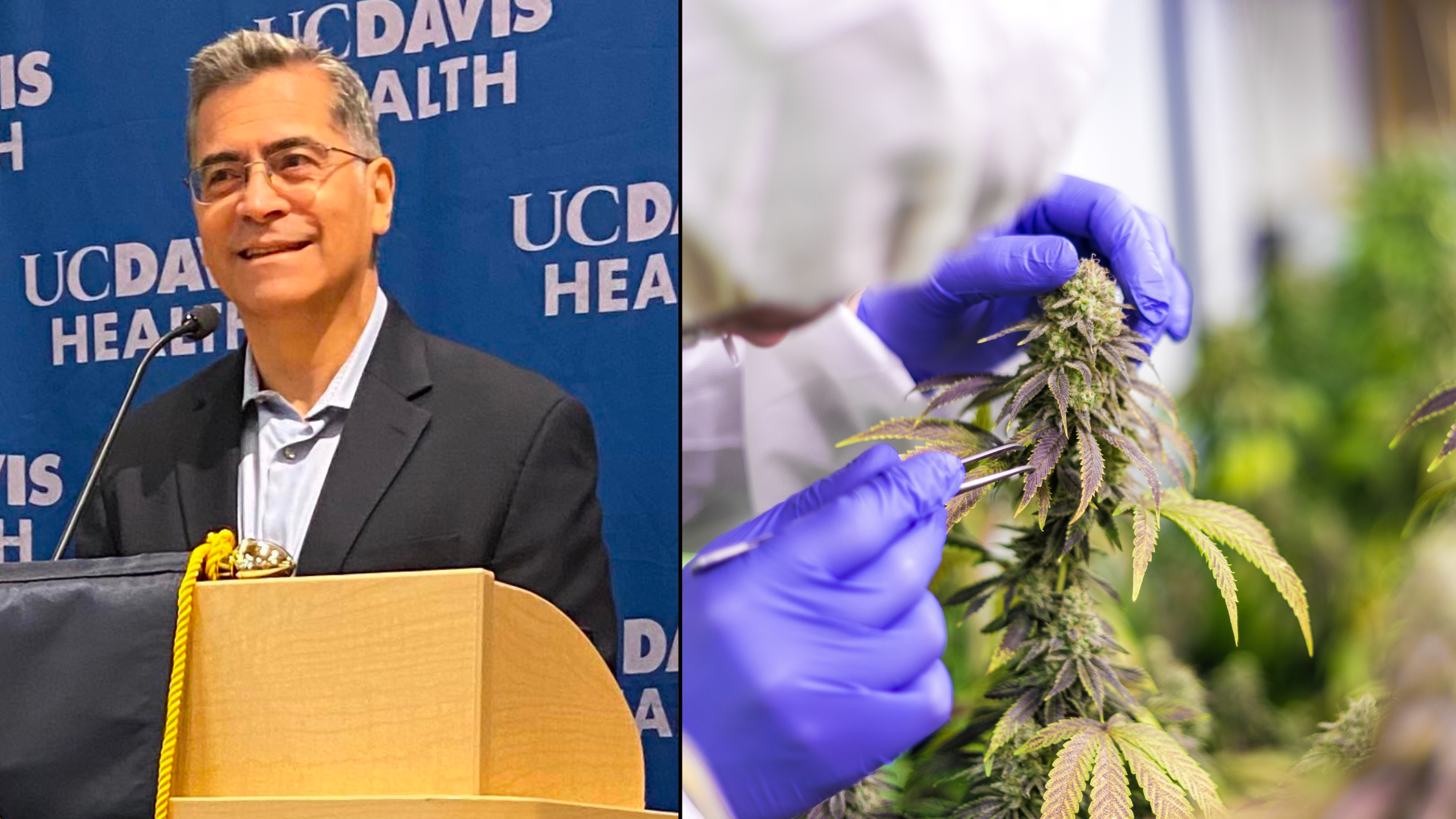

On August 30, Bloomberg reported a groundbreaking development in the cannabis industry. The Department of Health and Human Services (HHS) has sent a significant recommendation to the Drug Enforcement Agency (DEA) – the reclassification of cannabis from Schedule I to Schedule III. This move holds substantial implications, notably the potential removal of the burdensome 280e tax that currently restricts businesses from deducting many regular expenses, resulting in exorbitant federal tax rates ranging from 50% to 70%. Such a change promises to boost revenues for cannabis businesses.

However, several key questions remain unanswered, including when the DEA will respond, how this change affects pending legislation such as the SAFE and HOPE Acts, the timeline for implementation, and the necessity of Congressional action. Despite these uncertainties, experts unanimously agree that this marks a historic shift—the first major alteration related to cannabis from the Federal government in over half a century, and it doesn’t require an act of Congress.

Implications for Cannabis Investors

This move by HHS signals the end of an era in cannabis investment primarily driven by retail and high-net-worth investors. Here’s what investors should consider in the medium to long term:

Fundamental Valuations: Valuations for all cannabis companies are poised to start reflecting fundamentals as increased attention and capital flood into the industry. Viridian Capital Advisors‘ report indicates a remarkable increase in EV/2023 EBITDA ratios for publicly tracked companies within a week of the announcement—from 5.69x to 7.9x. Private market valuations tend to follow these trends with a slight lag. Thus, now is an opportune time for private equity investments to secure valuations that are likely to rise in tandem with public market valuations.

Capital Allocation Advantage: The ongoing uncertainty surrounding the timing and nature of Federal changes presents a unique advantage for those allocating capital in the cannabis sector at this juncture. This window of opportunity will gradually close as more clarity emerges from the Federal government.

Impact on Institutional Capital: Institutional capital will demand clearer regulatory steps before entering the industry, influencing private equity investments, mergers and acquisitions, and debt restructuring. Investments made at current valuations are likely to be recapitalized when more substantial institutional capital flows into the market.

Future Access to Capital: The future holds changes in valuations, increased liquidity, and industry consolidation through mergers and acquisitions. Companies that adeptly manage capital will thrive, while others may face challenges. The time to focus on the cannabis sector is now to reap the benefits of this impending transformation.

More detail around the specifics and ramifications can be found here, here, and here.

The Panther Group is ready to guide you in this evolving cannabis landscape, investing in companies poised for success during this shift. Please reach out if you are interested in discussing opportunities and connecting with our cannabis business network to info@thepanthergroup.co.

0 Comments